Commercial Loans to Power Your Business Growth

Expanding your business often requires the right financial support. At Better Rise Capital, we make it simple to access flexible Commercial Loans designed for purchasing property, financing equipment, or funding large-scale operations. Whether you’re a startup or an established enterprise, our Commercial Real Estate Loans and Business Loan options provide the stability your business needs to grow confidently.

What Is a Commercial Loan?

A Commercial Loan is financing provided to businesses for operational, expansion, or property-related needs. These can include Commercial Real Estate Loans, Commercial Property Loans, or Unsecured Commercial Loans each tailored to your goals.

From purchasing a new office building to refinancing existing property, our Commercial Lending Loans help maintain liquidity while building long-term assets for your company.

Types of Commercial Loans We Offer

At Better Rise Capital, we offer a diverse range of Commercial Business Loans to fit your specific goals:

Commercial Real Estate Loans

Ideal for purchasing or refinancing commercial properties like offices, warehouses, or retail outlets.

Commercial Property Loans

Tailored for acquiring or renovating real estate for business use.

Commercial Land Loans

Designed for purchasing undeveloped or investment property.

Unsecured Commercial Loans

Perfect for businesses that prefer financing without collateral.

Commercial Lending Loans

Structured funding solutions for working capital and expansion.

Why Choose Better Rise Capital

Whether you’re looking for instant working capital loans, low-interest business working capital loans, or a working capital loan without collateral, Better Rise Capital is your trusted partner for business growth.

Competitive Commercial Loan Rates

Access some of the best Commercial Real Estate Loan Rates in the market.

Flexible

Repayment

Choose terms that suit your business cash flow.

Quick

Approvals

Fast, transparent process from application to disbursal.

Expert

Guidance

Our team helps identify the right Commercial Loan Lenders and terms for your needs.

Property Financing Made Simple

From documentation to disbursement, we handle everything efficiently.

Commercial Loan Interest Rates

At Better Rise Capital, Commercial Loan Interest Rates are determined by several factors, including your business type, property value, credit profile, and repayment term. We provide transparent Commercial Property Loan Rates so you can make informed decisions without hidden costs.

Our Commercial Real Estate Loan Rates are designed to support long-term growth while keeping monthly obligations manageable.

Commercial Real Estate Loan Calculator

Plan your finances effortlessly using our Commercial Real Estate Loan Calculator.

This tool helps you estimate loan amounts, monthly installments, and total interest payable based on your preferred tenure and rate helping you budget smarter before you apply.

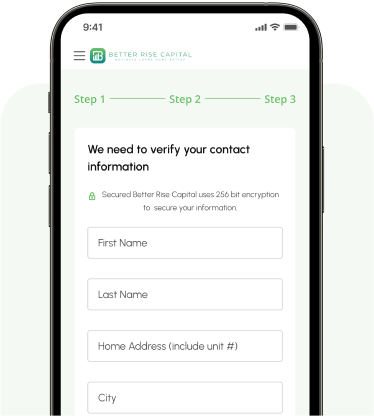

Eligibility & Requirements

To apply for a Commercial Loan, you typically need:

- Valid business registration documents

- Financial statements (last 6–12 months)

- Property documents (for real estate-based loans)

- dentity and address proof

Our team will guide you step by step through the application, ensuring a smooth and hassle-free approval process.

Property Financing Solutions

Looking to expand your business footprint? Our Property Financing options include loans for office spaces, retail stores, warehouses, and commercial complexes. With competitive rates and flexible tenures, Better Rise Capital ensures you get the best deal to fuel your growth.

Empowering Businesses with Flexible Commercial Loan Solutions

Every business has big goals, and we’re here to help you reach them.

Our commercial loans are designed for business owners who need larger funding amounts for major investments, expansion, or long-term growth opportunities.

With Better Rise Capital, you get personalized loan solutions backed by dedicated support and a streamlined process so you can focus on building your business.

Benefits of a Commercial Loan

Higher Funding Amounts

Flexible Repayment Terms

Choose loan terms that work for your business with options to match your cash flow and repayment ability.

Competitive Loan Rates

We offer highly competitive commercial loan interest rates based on your business qualifications and loan structure.

Growth Funding

Fuel expansion, invest in equipment, hire talent, or stock inventory, all with flexible commercial loan options.

Dedicated Loan Specialists

Our team works with you one-on-one to tailor a property financing solution that fits your goals and budget.

How to Qualify for a Commercial Loan

Qualifying is simple and applying won’t affect your credit score.

We look at several factors to determine the best loan commercial options for your business, including:

- Time in Business (6+ months preferred)

- Annual Revenue

- Business Credit Profile

- Cash Flow Strength

- Purpose of Loan

Our goal is to help you secure the most competitive commercial property loan rates and repayment terms for your specific needs.

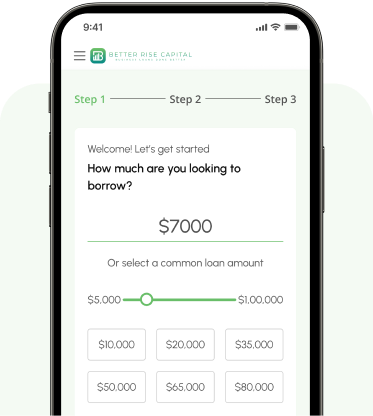

Quick & Easy Steps to Apply for Your Commercial Loan

Find out in minutes if you qualify for commercial real estate loans evenwith bad credit. Check your eligibility today without impacting your credit score.

Select the loan amount

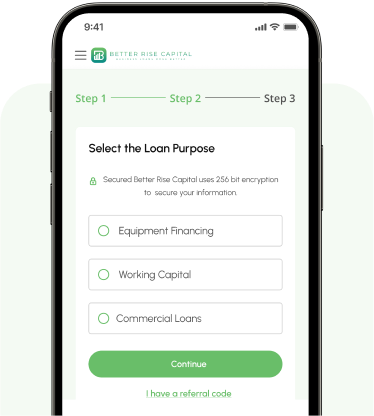

Select the loan you need

Talk with our loan experts to explore loan options and find terms that suit your needs. If you qualify, we’ll guide you smoothly into the application process.

Wait for Quick Approval

Experience the thrill of fast loan approval. Most

approved loans see funds disbursed to accounts

within one business day. Start your journey to

financial freedom today!

Customer Experiences with Our Commercial Loans Services

Samantha L., Franchise Owner

Derrick F., Distribution Company Owner

Michelle K., Healthcare Business Owner

Frequently Asked Questions

We’ve answered a few FAQs on business & commercial loans to get you started. But please don’t hesitate to reach out with more.

What is a commercial loan used for?

A Commercial Loan funds business activities such as property purchases, expansion, or working capital requirements.

Can I get a commercial loan without collateral?

Yes, our Unsecured Commercial Loans provide flexible funding without needing to pledge property.

How can I calculate my commercial real estate loan payments?

Use our Commercial Real Estate Loan Calculator to plan monthly repayments before applying.

What are the current commercial loan rates?

Commercial Loan Interest Rates vary based on your business profile and property value. Use our loan calculator to check estimated payments.

What is the difference between a commercial loan and a business loan?

A Business Loan is typically for operational use, while a Commercial Loan often involves property or large-asset financing.