Get customized Commercial Loans for Small Business and Commercial Real Estate Loans in California for property acquisitions, refinancing, and renovations. Quick approvals, competitive rates, and expert guidance for California businesses.

Every business has big goals and we’re here to help you achieve them. At Better Rise Capital, we offer commercial loans for small businesses and commercial real estate loans in California tailored for property acquisitions, refinancing, renovations, and business expansion.

Whether you’re investing in new facilities or upgrading existing ones, our flexible financing solutions are designed to support your long-term growth.

With quick approvals, competitive rates, and expert guidance, we simplify the loan process so you can focus on building your business. Let us provide the capital you need to turn opportunities into success.

Commercial loans from Better Rise Capital offer the flexibility and financial strength you need to take your business to the next level.

Choose loan terms that work for your business with options to match your cash flow and repayment ability.

We offer highly competitive rates based with clear terms, flexible prepayment on your business qualifications and loan structure.

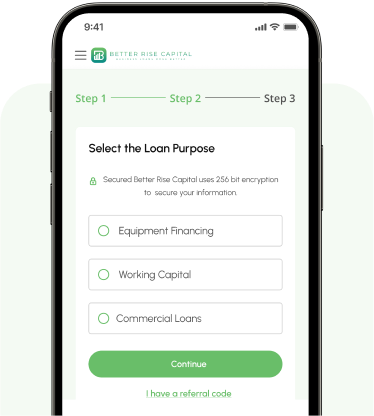

Power your business growth with flexible commercial loans, whether it’s expanding operations, purchasing equipment, hiring top talent, or boosting inventory.

Our team works with you one-on-one to tailor a financing solution that fits your goals and budget.

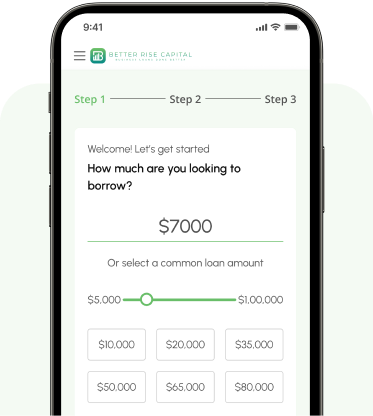

Access between $50,000 and $1,000,000+ in capital to support your long-term business goals.

Choose loan terms that work for your business — with options to match your cash flow and repayment ability.

We offer highly competitive rates based on your business qualifications and loan structure.

Our team works with you one-on-one to tailor a financing solution that fits your goals and budget.

Qualifying is simple, and applying for a commercial loan won’t affect your credit score.

We look at several factors to determine the best commercial loan options for your business, including

We help you secure commercial real estate loans, business loans, and commercial equipment financing with favorable loan rates and repayment terms suited to your goals, even with bad credit.

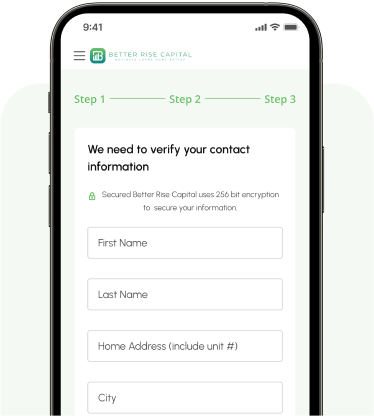

Find out in minutes if you’re eligible for commercial loans, without affecting your credit score with Better Rise Capital.

Fill out our simple form with the amount you need and set your preferred time for a callback. We align our loan advisors with your schedule for utmost convenience.

Talk with our loan experts to explore loan options and find terms that suit your needs. If you qualify, we’ll guide you smoothly into the application process.

Experience the thrill of fast loan approval. Most approved loans see funds disbursed to accounts

within one business day. Start your journey to financial freedom today!

“Expanding our business was a big move for us, and Better Rise Capital made it possible. Their team helped us structure a commercial loan that fit our long-term goals perfectly.”

Samantha L., Franchise Owner

Derrick F., Distribution Company Owner

Michelle K., Healthcare Business Owner

To qualify, our loan advisors typically assess your business financials, property value, loan-to-value (LTV) ratio, debt service coverage ratio (DSCR), and time in business. Even with bad credit, flexible loan options may be available through us.

Yes, it’s possible. We offer offer commercial real estate loans in California to California residents with bad credit. We prioritize property equity and business cash flow over credit score alone.

Unsecured commercial loan rates in California generally range from 8% to 25%, depending on your credit profile, time in business, and lender type.We offer competitive fixed rates, while private lenders may offer faster funding at higher rates.

Yes, we offer commercial loans that are specifically tailored for small businesses, including commercial property loans, working capital loans, and equipment financing. Lenders may evaluate revenue, time in business, and growth potential over credit alone.

You can apply online by submitting a short form with your business details, loan amount, and property or financing purpose. Some lenders offer soft credit checks and pre-approvals within 24–72 hours.

At Better Rise Capital, we make lending of commercial loans and property financing simple, flexible, and built around your goals. Let us help you secure the capital you need to take your business to the next level.