Equipment Financing Loans to Empower Your Business

Upgrading your tools, machinery, or technology shouldn’t slow down your business growth. At Better Rise Capital, we make Equipment Financing simple, fast, and affordable, helping you acquire essential business equipment without large upfront costs. Whether you’re a startup, a restaurant, or a construction company, our Business Equipment Financing solutions are designed to keep your operations running efficiently.

What Is Equipment Financing?

Equipment Financing allows businesses to purchase or lease the machinery, tools, and technology they need while preserving cash flow. Instead of paying the full cost upfront, you can spread payments over time with flexible terms.

From Heavy Equipment Financing for construction to Restaurant Equipment Financing or Agricultural Equipment Financing, our loans help companies across industries stay competitive and productive.

Types of Equipment Financing We Offer

At Better Rise Capital, we understand that every business has unique equipment needs. Our financing options include:

Equipment Lease Financing

A cost-effective solution to lease equipment with the option to own it later.

Small Business Equipment Financing

Ideal for startups and small enterprises looking to expand without depleting working capital.

Commercial Equipment Financing

Structured for large corporations with significant machinery and asset requirements.

Construction Equipment Financing

Tailored for contractors and builders purchasing or leasing heavy machinery.

Restaurant Equipment Financing

Simplify purchases for kitchen appliances, POS systems, or delivery tools.

Agricultural Equipment Financing

Perfect for farmers needing tractors, harvesters, or irrigation equipment.

Grow Smarter with Affordable Equipment Financing Loans

Benefits of Equipment Financing Loans

Financing for business equipment is essential for growing your business, but it doesn’t have to drain your cash flow. Equipment financing loans for startups and well-established businesses from Better Rise Capital provide smart, flexible options that help you get the tools you need while keeping your business financially healthy.

Keep Cash in Your Business

Minimize Financial Risk

Avoid large upfront costs and reduce the financial risk of purchasing expensive equipment outright. Financing helps you manage payments over time with terms that fit your budget.

Protect Against Rising Prices

With financing, you can lock in today’s equipment costs while paying over time — helping your business hedge against inflation and increasing equipment prices.

Stay Ahead with New Technology

Safeguard Your Personal Finances

Maximize Tax Savings

Keep Cash in Your Business

Minimize Financial Risk

Avoid large upfront costs and reduce the financial risk of purchasing expensive equipment outright. Financing helps you manage payments over time with terms that fit your budget.

Protect Against Rising Prices

With financing, you can lock in today’s equipment costs while paying over time — helping your business hedge against inflation and increasing equipment prices.

Stay Ahead with New Technology

Equipment financing gives you access to the latest technology, tools, and machinery — so you can stay competitive and avoid falling behind in your industry.

Safeguard Your Personal Finances

Maximize Tax Savings

Why Choose Better Rise Capital

Whether you’re looking for instant working capital loans, low-interest business working capital loans, or a working capital loan without collateral, Better Rise Capital is your trusted partner for business growth.

Fast Approval & Funding

Get quick access to funds for new or used equipment.

Flexible

Terms

Choose between short-term Equipment Loan or long-term Equipment Leasing and Finance.

Competitive Equipment Financing Rates

Transparent interest rates with no hidden fees.

Startup

Support

Access Equipment Financing for Startups, even with limited credit history.

Personalized

Solutions

Whether you need Business Equipment Finance or Commercial Equipment Financing, we’ll customize a plan for your business.

How Equipment Financing Works

- Choose the Equipment: Identify what you want to purchase or lease.

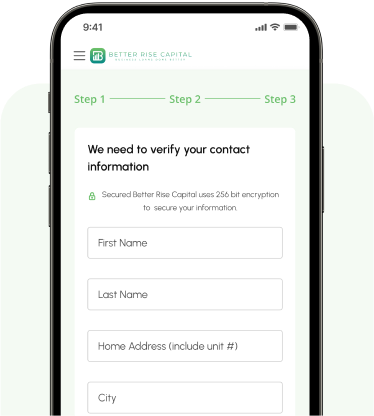

- Submit Application: Share basic business and financial details..

- Get Approved Quickly: We review your profile and offer the best Equipment Financing Rates.

- Funds Disbursed: Receive funds directly or through a vendor to complete your purchase.

Equipment Financing for Startups

We understand that startups often face challenges accessing capital. That’s why we offer Equipment Financing for Startup Businesses with minimal documentation and flexible repayment options. Even if you’re a new venture, you can qualify based on revenue potential, contracts, or cash flow forecasts.

Equipment Financing Calculator

Plan better with our Equipment Financing Calculator.

Estimate your loan amount, tenure, and interest payable, and choose the most affordable repayment structure for your business.

How to Qualify for Equipment Financing Loans

It’s quick and easy to see if you qualify, with no impact on your credit score. We work to secure the best equipment financing rates and terms tailored to your needs.

- Your business credit history

- Equipment type and value

- Industry and years in business

- Financial strength and cash flow

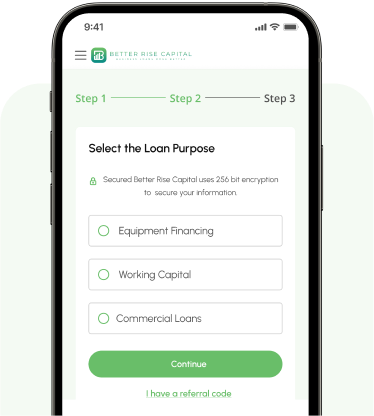

Fast & Simple Loan Process For Equipment Financing

Find out in minutes if you’re eligible, without affecting your credit score for equipment lease financing.

Select the loan amount

Select the loan you need

Talk with our loan experts to explore loan options and find terms that suit your needs. If you qualify, we’ll guide you smoothly into the application process.

Wait for Quick Approval

Experience the thrill of fast loan approval. Most

approved loans see funds disbursed to accounts

within one business day. Start your journey to

financial freedom today!

What Our Customers Are Saying

“We needed euipment financing for startup and Better Rise Capital made it quick and painless. The terms were flexible, and the process was clear from start to finish.”

Jason D., Auto Repair Shop Owner

“Without equipment financing, we wouldn’t have been able to upgrade our kitchen in time for our restaurant expansion. The team at Better Rise Capital was fantastic to work with.”

Laura P., Restaurant Owner

“We secured heavy equipment financing for our macheneries in just a few days. No hidden fees, no complicated paperwork. Just straightforward, reliable service.”

Brian C., Construction Business Owner

Frequently Asked Questions

What is the difference between equipment financing and leasing?

Equipment Financing lets you own the equipment by the end of the loan term, while Equipment Leasing and Finance provides access without ownership until the lease ends.

What are typical equipment financing rates?

Equipment Financing Rates depend on your credit profile, equipment cost, and repayment tenure. Use our calculator to get an estimate.

Is collateral required for equipment financing?

In most cases, the equipment itself serves as collateral no need for additional security.

Can startups get equipment financing?

Yes, we specialize in Equipment Financing for Startups and help new businesses secure the tools they need to grow.

What industries qualify for equipment loans?

Construction, manufacturing, farming, restaurants, logistics, and many others qualify for Business Equipment Financing.

Fast, Industry-Leading Equipment Financing Approvals for Your Business

Getting the equipment you need shouldn’t be complicated. With Better Rise Capital, our simple, streamlined equipment financing loan process helps you access funding faster, so your business can keep moving forward. Whether you’re a startup or an established company, we make equipment financing for business easy, affordable, and tailored to your needs. Get started today and see how simple it can be to fuel your growth.

Our Latest Blogs

Stay informed with our latest news and insights on digital marketing trends, strategies,

and tips to help you grow your business.

From Paperwork to Performance: How Technology Is Reshaping Commercial Lending

Access to capital is a critical factor in how small businesses grow, scale, and stay competitive. Whether you are purchasing commercial property, expanding operations, or

- udit t

Commercial Loans for Small Business: Property, Unsecured & Business Financing Solutions

Access to capital is a critical factor in how small businesses grow, scale, and stay competitive. Whether you are purchasing commercial property, expanding operations, or

- udit t

Common Cash Flow Mistakes Small Businesses Make – And How Working Capital Loans Can Fix Them

Cash flow problems are one of the biggest reasons small businesses struggle or shut down, even when sales look healthy. In 2025, rising costs, delayed

- udit t

Working Capital Loans vs Business Credit Cards: Which Is Better for Small Business Cash Flow in 2025?

Managing cash flow is one of the biggest challenges for small businesses in 2025. With rising operating costs, delayed payments, and unpredictable demand, business owners

- udit t

How AI & Digital Tools Are Changing the Way Small Businesses Use Working Capital Loans in 2025

In the last few years, the lending industry has undergone a dramatic transformation. With the rise of AI-driven financial tools, automated underwriting systems, and digital

- udit t

Why Working Capital Loans Are Becoming Essential for Small Businesses in 2025

Running a successful small business today means more than just selling a good product it means adapting quickly, managing cash flow smartly, and staying financially

- udit t